Malaysia Car Tax

Tax tables in Malaysia are simply a list of the relevent tax rates fixed amounts and or threholds used in the computation of tax in Malaysia the Malaysia tax tables also include specific notes and guidance on the validity of scenarios for example qualifying criterea for specific tax relief allowances and notes of the calculation of phaseout of specific tax elements within each. The calculator is designed to be used online with mobile desktop and tablet devices.

How Much Does A Car Cost In Singapore Vs Malaysia Carsomesg Com

Malaysia S Road Tax Structure Explained In Detail

Road Tax Calculator Is Now Available Motor Trader Online Facebook

EVs in Malaysia to be completely tax free soon zero import and excise duties free road tax.

Malaysia car tax. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. In the draft proposal the ministry has not stated a reason for not applying tax reduction to imported cars.

Corporate Tax Rate in Malaysia averaged 2612 percent from 1997 until 2021 reaching an all time high of 30 percent in 1997 and a record low of 24 percent in 2015. Leasing with DriveMYs new auto-quoter service is the smart new way to look for the right car for yourself or your business. Malaysia Car Insurance Malaysia Road Tax Renewal MALAYSIA ROAD TAX CALCULATOR Harga Cukai Jalan Setahun CLICK HERE TO RENEW YOUR CAR INSURANCE ROAD TAX TEKAN SINI UNTUK ANGGARAN TAKAFUL CUKAI JALAN or Contact Us 60123737601.

The road tax calculation is based on engine capacity. A person or a group of people related or unrelated who usually live together in a living quarters and make provisions expenses for food and other necessities of life together. The system is thus based on the taxpayers ability to pay.

Neighbouring countries like Indonesia and Malaysia have also offered preferential treatment to their domestic automobile industry amid the Covid-19 outbreaks. Mitsubishi Motors Malaysia reserves the right to alter any details of specifications and equipment without prior notice. Best Car Loans in Malaysia Whether youre buying a new or used car youll find our comprehensive Malaysian auto loan list steers you in the right direction.

Corporate Tax Rate in Malaysia remained unchanged at 24 percent in 2021 from 24 percent in 2020. Lease rentals for passenger cars exceeding RM50000 or RM100000 per car the latter amount being applicable to vehicles costing RM150000. Along with the other announcements made during the tabling of Bajet 2022 earlier today the government has also detailed the various initiatives planned for the development of electric vehicles EVs in Malaysia.

Youll be charged for. Household members who receive income in the. In 2019 the average size of Malaysian households was 39 persons.

How to file your personal income tax online in Malaysia. Finance Minister Zarful Aziz put forward in Parliament the budget proposal of 3321 billion ringgit 802 billion up from 3206. Under the single tier system income tax payable on the chargeable income of a company is a final tax in Malaysia.

Road tax fee 2. In Cars Hybrids EVs and Alternative Fuel. Get 100 driving pleasure and 0 hassle when you lease a car in Malaysia.

Renew your road tax driving license online in Malaysia through MYEG. Gone are the days of queuing up in the wee hours of the morning at the tax office to complete your filing. When looking at the specifications of the car we can see that the 24L version has 2354cc engine.

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing. This page provides - Malaysia Corporate Tax Rate - actual values historical data forecast chart statistics economic calendar and news. KUALA LUMPUR Oct 29 Electric car enthusiasts or those wishing to buy one will now get tax exemption as part of Budget 2022 incentives.

For vehicles used in East Malaysia you can still renew your car insurance online without selecting road tax. Finance Minister Datuk Seri Tengku Zafrul Abdul Aziz said the government wants to encourage people to buy these vehicles and their long-term plan is to make Malaysia carbon neutral by 2050. So more user will accept hybrid benefit.

The road tax in East Malaysia is lower due to the conditions of the road and its supporting infrastructures. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make sure you. Vehicle and specifications may vary from models available locally.

Review the full instructions for using the Malaysia Salary After Tax Calculators which details Malaysia tax. KUALA LUMPUR Malaysia AP Malaysias government on Friday proposed record spending for 2022 to bolster post-pandemic economic recovery with various industrial incentives and cash handouts for the poor and windfall taxes for high-income companies. According to finance minister Tengku Zafrul Tengku Abdul Aziz the government sees the potential of EVs to help reduce air pollution on top of also being energy efficient.

At the same time gov should push all petrol station within malaysia to install at lest 2 EV charging. Cars with more than 1000cc will pay 50 less of the road tax price in West Malaysia. Lets go through the private car calculation with the Proton Perdana mentioned at the start.

Gov should push Hybrid car first with 100 tax free. Income tax deadline 2021. Details of specifications and equipment are also subject to change to suit local conditions and requirements.

Based on the Private Cars in. How to calculate your road tax amount. In 2020 the Malaysian car manufacturer Perodua sold approximately 220 thousand cars and therefore remains on leading the Malaysian automotive market despite a.

Use our car loan calculator to find finance that matches your budget. What type of charges are involved when I renew road tax with AIG Car Insurance online. Road users in West Malaysia and East Malaysia are taxed at a different rate.

The Monthly Wage Calculator is updated with the latest income tax rates in Malaysia for 2021 and is a great calculator for working out your income tax and salary after tax based on a Monthly income. This means that low-income earners are imposed with a lower tax rate compared to those with a higher income. The insurer of the other vehicle does not do business in Malaysia for example a SingaporeThai vehicle hit your car in Malaysia.

MyEG delivery charges Klang Valley RM6 Peninsular Malaysia RM8 Sabah Sarawak RM10 3. The other vehicle is a bus taxi limousine or hire drive vehicle GrabUber etc The other vehicle is not identifiable ie you do not know with certainty the registration number of the vehicle. Weve got flexi loans graduate loans low interest rate loans and the best used car loans on the market.

You can file your taxes on ezHASiL on the LHDN website. In both East and West Malaysia the road tax increases as the engine displacement of the car increases. Register with us today.

Long Term Car Leasing An alternative to worry free car ownership. The concepts and terms used here are summarised as. Malaysias government is proposing a record budget for 2022 to bolster an economic recovery following the coronavirus pandemic with industrial incentives and.

Topgear Ev Talk Why The New Tesla Model S S Road Tax Would Cost Rm17k In Malaysia

Check Road Tax Check Com My

Will Car Prices Go Up Or Down The Star

Road Tax Amount For West East Malaysia Private Company Cars Suv Mpv And Motorcycles

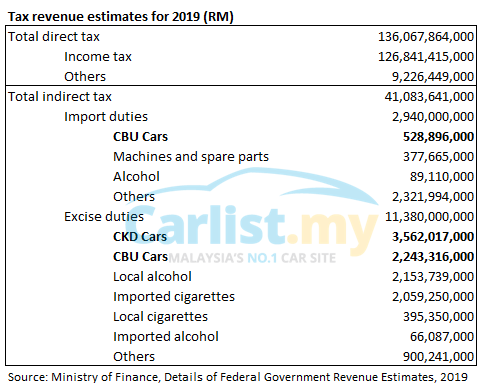

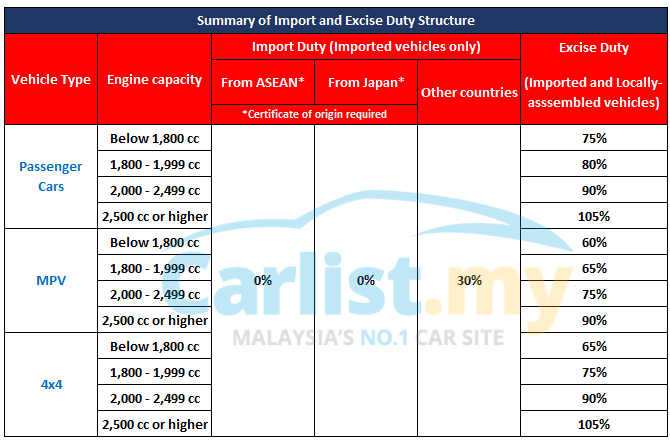

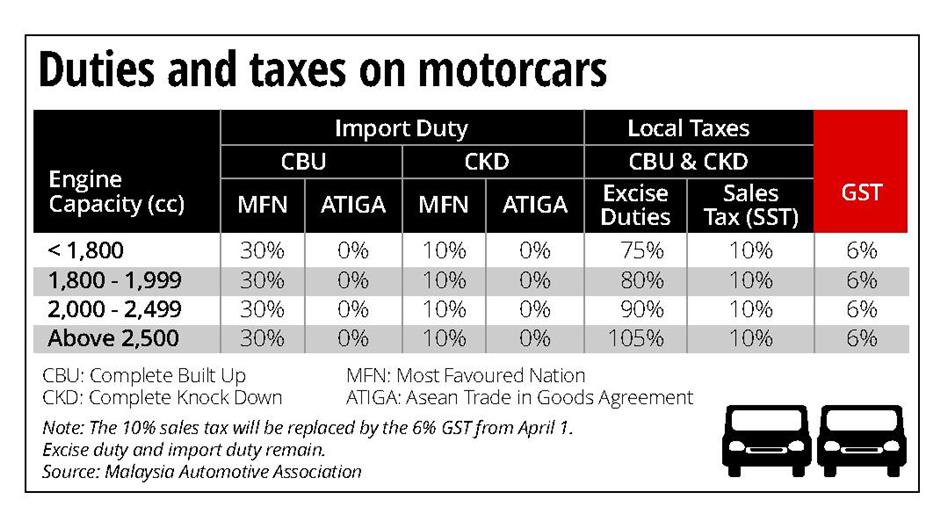

New Motor Vehicle Tax Structure Announced By Ministry Of Finance Autoworld Com My

Government Mulls Lower Excise Duty For Cars How Low Will Prices Go How Realistic Is It Insights Carlist My

Government Mulls Lower Excise Duty For Cars How Low Will Prices Go How Realistic Is It Insights Carlist My

Malaysia S Road Tax Structure Explained In Detail

Komentar

Posting Komentar